Liquidity is the Only Signal for SMEs

The 2026 SME Mandate: Own Your Cash Flow. Marking the End of Financial Abstraction and the Return of the Hard Constraint

Wednesday 14th January 2026

[5 min read]

For a decade, leadership was insulated by the "buffer of the abstract", cheap debt, high-burn venture cycles, and the luxury of looking at the balance sheet once a quarter. In 2026, those buffers have evaporated. We have entered an era of high-velocity volatility where cash flow is no longer a back-office concern relegated to the CFO’s ledger.

It is THE leadership issue. In a world of algorithmic markets and compressed feedback loops, liquidity has become the only high-fidelity signal of a company's health. To lead SMEs today is to understand the "physics" of your capital in real-time. Those who can predict their flow will command the market; those who treat it as an administrative byproduct will cease to exist.

Most SMEs don’t fail because demand disappears overnight. They fail because leaders lose visibility into what’s coming next. By the time cash feels tight, decisions are already constrained.

Owning your cash flow today means more than tracking balances. It means understanding the signals that show where money will be, not just where it has been.

This article explains:

what cash flow actually is (and what it isn’t)

how it differs from profit and balance sheets

the real drivers of cash flow change in SMEs

the signals that matter most

and the common pitfalls that quietly undermine control

Cash Flow 101: What It Is, What It Isn’t, and Why It Matters

Cash flow is simple in concept and unforgiving in practice.

It is the movement of money in and out of your business over time.

Cash flow is not profit.

It is not revenue.

And it is not what your accountant shows you once a year.

A business can be profitable and still run out of cash if money arrives later than expected or leaves faster than planned.

What’s Included in Cash Flow

Cash flow reflects:

money received from customers

payments to suppliers and partners

wages, tax, and operating expenses

loan repayments and financing

one-off costs such as equipment, legal fees, or VAT

Timing matters as much as totals.

When money moves is often more important than how much moves.

Cash Flow vs P&L vs Balance Sheet (broken down)

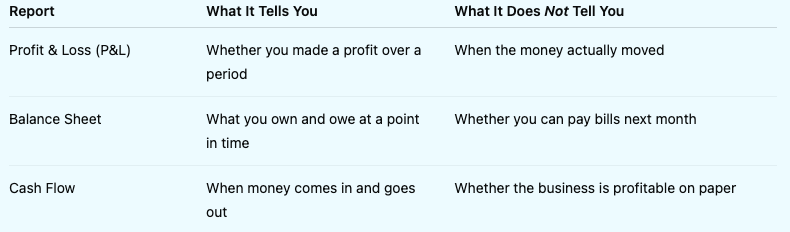

These three reports answer different questions. Confusing them is one of the most common causes of cash flow stress.

Florido Cashflow 101: Key differences between Cashflow vs P&L vs B/S

A business can look healthy on a P&L and balance sheet and still struggle to meet payroll.

This is why cash flow is a leadership issue, not just an accounting one.

The Main Drivers of Cash Flow for SMEs

For most SMEs, cash flow is shaped by a small number of forces:

Customer payment timing

When invoices are paid, not when they are issued.Sales cycle length

How long it takes to turn interest into cash.Cost structure

Fixed costs versus flexible costs.Revenue concentration

Dependence on a small number of clients.Growth pace

Growth often consumes cash before it generates it.

Small changes in any of these can have a large impact.

Common Cash Flow Pressures SMEs Face

Cash flow pressure often builds quietly.

Typical sources include:

customers paying later as markets tighten,

discounts creeping in to close deals,

headcount, contractors, or software added ahead of revenue,

new distribution channels changing billing and settlement timing,

growth outpacing working capital.

None of these issues appear clearly in a single report. They show up as patterns over time.

The Most Common Cash Flow Mistakes

Across SMEs, the same mistakes appear again and again:

Confusing profit with cash

Assuming “we’re profitable” means “we’re safe.”Looking backwards only

Reviewing last month instead of watching what’s changing now.Over-trusting forecasts

Relying on detailed projections built on assumptions no one revisits.Ignoring behavioural signals

Missing early changes in customer or sales behaviour.Underestimating partner and channel impact

New distributors or platforms often change cash timing, data access, and visibility in ways that aren’t planned for upfront.

Cash flow problems rarely arrive without warning. They arrive when warnings are missed.

Why Cash Flow Signals Matter More Than Reports

Reports tell you where you’ve been.

Signals show you where you’re heading.

A cash flow signal is a small, repeatable pattern that hints at what’s coming next. It’s not a forecast model or a complex spreadsheet. It’s an early indicator that something is shifting.

Examples include:

customers paying a few days later than normal,

deals taking longer to close than they used to,

a growing share of revenue coming from fewer clients,

costs becoming fixed while income remains variable.

One signal on its own rarely causes alarm. Several moving together usually should.

The Cash Flow Signals That Matter Most for SMEs

1. Payment behaviour drift

Reliable customers start paying later, gradually and then suddenly.

What to watch:

average days to pay,

changes by customer group,

repeat late payers.

Why it matters: Small delays compound quickly and reduce planning confidence.

2. Revenue concentration

Too much dependence on too few customers.

What to watch:

percentage of revenue from top clients,

whether new revenue diversifies or reinforces dependence.

Why it matters: One delayed or disputed invoice can disrupt an entire month.

3. Sales pipeline ageing

Deals that used to close in 30 days now take 45 or 60.

What to watch:

average deal duration,

stalled opportunities,

discounts appearing earlier in the cycle.

Why it matters: Cash inflow slows before revenue officially drops.

4. Cost timing mismatch

Costs lock in faster than revenue does.

What to watch:

payroll versus predictable income

software and subscription creep

“temporary” costs that quietly become permanent

Why it matters: Margins can look stable while cash tightens underneath.

Using Cash Flow Signals Without Overengineering

Many SMEs assume they need complex forecasting models to gain control. In practice, this usually adds noise.

A better approach:

Choose three signals only

More creates complexity without clarity.Track movement, not perfection

Direction matters more than precision.Review monthly, not constantly

Signals lose value when they become background noise.Link every signal to an action

If a signal doesn’t change behaviour, it isn’t doing its job.

Control comes from consistency, not complexity.

The Hidden Risk: Partners, Platforms, and New Channels

As SMEs grow, they often add distributors, platforms, or strategic partners. This is where cash flow visibility frequently breaks.

Common issues include:

different legal rules around customer data and payments

incompatible reporting formats

limited insight into partner-owned billing or collections

assumptions that internal cash flow models still apply

When this is overlooked, businesses discover too late that:

cash timing across channels can’t be compared

forecasts no longer reflect reality

compliance and operational risk have increased

Growth through partners only works when cash flow data rules are agreed up front, not discovered later.

How to Get Started (The Practical Way)

You don’t need perfect forecasting to regain control.

Start here:

pick one cash-related question that causes stress

use existing accounting, banking, and sales data first

look for changes over time, not absolute answers

introduce automation only after insight is trusted

If you can spot risk earlier than last quarter, it’s working.

How Florido Helps SMEs Own Their Cash Flow

At Florido, we treat cash flow as a leadership signal, not just a finance metric.

We help SMEs:

Identify the few signals that genuinely affect cash

Connect financial and operational data simply

Avoid overconfidence in fragile forecasts

Maintain clarity as new partners and channels are added

“Cash flow isn’t about predicting the future perfectly. It’s about managing resources and risk well enough that surprises don’t run the business.”

Stay tuned. Keep your finger on The Pulse.

Get a clear view of the signals shaping your cash position and where control may be slipping.