Grab the Data. Use It. Don’t Let It Kill You.

In 2026, most SMEs don’t have a data problem. They have a clarity problem.

Wednesday 7th January 2026

[6 min read]

Businesses are collecting more information than ever, yet still making decisions based on gut feel, partial reports, or last month’s numbers. Sales feel unpredictable. Cash flow surprises keep coming. Marketing works, until it doesn’t.

Data can fix this. Or it can quietly make things worse.

The difference is not how much data you have, but how deliberately you use it.

This Pulse article explains and then explores, in plain language:

what data science actually is (and what it isn’t),

how it differs from AI,

How SMEs can realistically use data in 2026,

and the common traps that cause data projects to stall, overcomplicate, or backfire.

Let’s Start with a Common (and easy) Misconception: Data Science vs AI

These two terms are often bundled together, but they do different jobs.

Data science: understanding what’s going on

Data science is about finding patterns in information so you can make better decisions.

In simple terms, it helps answer questions like:

Why are customers paying later than they used to?

Which products are quietly losing margin?

What is likely to happen to cash flow over the next 30–60 days?

Data science looks at what has happened and what is likely to happen next.

AI: acting on that understanding

AI is what uses those insights to take action automatically.

For example:

Data science shows that customers who haven’t logged in for two weeks often cancel.

AI sends an automatic message or flags the account for follow-up.

A simple, useful rule of thumb for Data Science vs AI

Data science explains.

AI executes.

You can use data science without AI.

You should rarely use AI without data science.

Grab the Data: What SMEs Already Have (and often Overlook)

Many SMEs assume they need new systems to “be data-driven.” In reality, most SMEs already sit on valuable information.

Common sources include:

accounting and banking data

invoices and payment history

CRM notes and sales pipelines

website enquiries and conversion data (incl search console data)

support emails and service logs

personal data & IP address/delivery addresses

POS activity from tills and payment gateways

3rd party data sources, e.g. wifi hotspot logins, loyalty card activations, footfall counters, customer reviews, social media, sales channel and distribution data

In 2026, accessing this data is no longer expensive or technical:

Open banking and accounting connections provide near real-time financial visibility

Low-code tools connect systems without custom development

Privacy-first analytics allow insight without intrusive tracking

The goal is not to collect everything.

It’s to connect the few sources that reflect how the business actually operates.

Use It: Practical Data Science for Real SME Problems

When used well, data science helps SMEs move from reacting late to acting early.

Here are three high-impact examples we see repeatedly:

1. Predictive cash flow

Instead of checking what’s in the bank today, data models estimate what will be there in 30 or 45 days by learning from:

customer payment habits

seasonality

historical delays

This turns cash flow from a surprise into a forecast.

2. Early warning signals for churn

Small behavioural changes often appear weeks before a customer leaves:

fewer logins

slower responses

reduced usage

Simple models can flag these changes early, giving teams time to intervene.

3. Margin and pricing visibility

By combining cost data, pricing, and volume trends, SMEs can spot:

products that look profitable but aren’t

discounts that quietly erode margin

customers who cost more to serve than they generate

None of this requires a data science department. It requires focus.

Still making decisions based on instinct alone?

Let Florido help you see what your existing data is already telling you >>>

Don’t Let It Kill You: The Real Risks in 2026

Most data failures in SMEs come from common routes: doing too much, too fast and trusting outputs without context.

The 5 most common pitfalls

Overcomplication

Too many dashboards, too many metrics, no clear decisions attached to them.False confidence

Tools produce precise-looking numbers that hide flawed assumptions or incomplete data.Unintended consequences

Automated decisions based on old or biased data lead to unfair pricing, missed opportunities, or customer frustration.Security and access creep

Sensitive reports are shared too widely or stored without clear ownership.Poor governance when adding partners and channels

This is one of the most overlooked and costly pitfalls.When SMEs add new distribution channels or strategic partners, the data rarely behaves the same way it does internally.

Common issues include:different legal obligations around customer data,

incompatible data formats or reporting standards,

limited visibility into partner-owned data,

assumptions that existing analytics and permissions still apply.

Without clear planning and governance, businesses discover too late that:

Key data cannot be shared or analysed as expected

Compliance risks have increased

Performance across channels can’t be compared reliably

The result is fragmented insight, slower decisions, and expensive rework at exactly the moment the business is trying to scale.

The aim always should be = Data should reduce risk, not introduce new ones.

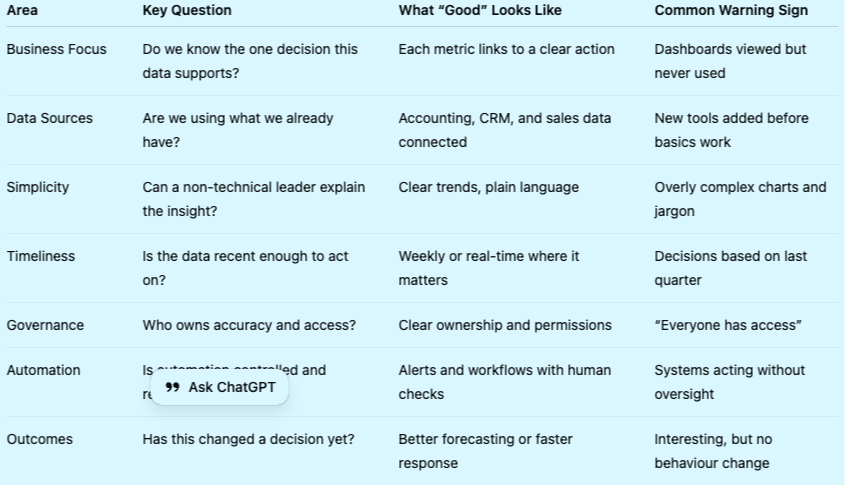

The Florido Checklist: A Free Practical Data Reality Check for SMEs

Use this free checklist to assess whether your data is helping or quietly holding your SME back.

Florido Data Checklist for SMEs

How to Get Started (Without Overengineering)

A practical starting point for 2026 looks like this:

Define one problem

For example: late payments, unpredictable sales, or declining engagement.Use existing data first

Before buying anything new, consider (and integrate with) what you already use.Look for patterns, not perfection

Directional insight is often enough to act.Add automation last

Only automate decisions you already trust.

Progress is measured by better decisions, not better dashboards.

“The SMEs that succeed in 2026 won’t be the ones with the most data. They’ll be the ones who use it with intent, discipline, and restraint.”

How Florido Helps?

At Florido, we see data as a tool for leadership, not a technical exercise.

We help SMEs:

decide what truly matters to measure

turn scattered signals into usable insight

avoid over-automation and governance blind spots

and focus data efforts on cash flow, growth, and operational clarity.

Stay tuned. Keep your finger on The Pulse.

The technology matters, but the thinking matters more. Not sure where to start with data?